© Bill & Melinda Gates Foundation/Prashant Panjiar

Summary:

Covid-19 has hit countries across the world hard. And while Uganda has been largely spared from the worst health impacts of the pandemic, lockdowns and restrictions put in place to curb the spread of the disease have had enormous economic effects on people with the least capacity to manage them. Grameen has been working to link women's groups in Ugandan refugee settlements to formal financial services since 2019, so when the pandemic hit we were challenged to find ways to adapt our programming approaches to a Covid-affected reality and also respond to the needs of the most vulnerable women in our groups. To accomplish both, we leveraged digital training and digital financial services (DFS) tools as well as the advice of our local partners, women's groups and government officials.

Impact of Covid-19 and Social Distancing Restrictions on Refugees in Uganda

The East African nation of Uganda hosts the sixth largest refugee population in the world, totaling 1.4 million refugees from South Sudan, Democratic Republic of Congo, Rwanda and Ethiopia and is noted for having one of the most generous and progressive refugee policies in the world. But refugees are still in an extraordinarily difficult situation, with some of the highest poverty rates in the country, little land and few economic opportunities. The onset of the global Covid-19 pandemic made their situation more tenuous. Uganda declared a nationwide lockdown and curfew in March 2020 in a bid to prevent the spread of the disease to its residents, with especially strong restrictions on border districts to prevent infections from neighboring South Sudan and D.R.C. People in border districts were not allowed to travel in and out of their district, all businesses were closed, and all travel was banned into and out of refugee settlements. Public gatherings of more than five people were also banned. These restrictions severely limited business and farming activities and effectively halted 90% of aid support to the settlements for four months. At the same time, World Food Programme food assistance to refugees was cut by 30% due to funding shortfalls.

Grameen’s Work with Refugee Women’s Groups in West Nile

Since 2019, Grameen Foundation has been working with RUFI Microfinance Institution (MFI) to connect South Sudanese refugee women's groups to formal financial services and business skills to help them start and expand sustainable businesses and begin to rebuild their lives. Our program works through a three-pronged approach:

- Linking groups to formal loans at RUFI MFI using LedgerLink, our digital savings group platform, to digitize group records and develop alternative credit histories;

- Technically supporting RUFI to develop appropriate group loan products, policies and procedures to extend loans to vulnerable refugee populations;

- Preparing women’s savings groups to manage loans effectively for business or household purposes through financial education.

Our program has been working with approximately 7,000 refugee women in 295 groups in four refugee settlements in northwestern Uganda, leveraging the regular meetings of women's savings groups to discuss financial products, process bank account opening and loan applications, and check how groups are doing with the digital savings group platform. By the end of the project, all of our groups will have access to the digital savings group platform and we are aiming for 150 groups to have access to a secured Group E-Wallet to securely transfer funds from their deposits directly to a specialized group bank account at Centenary Bank. But when Covid-19 hit, we were challenged to find new ways to continue running our programs and also respond to the effects of Covid-19 on our already vulnerable group member’s lives.

Adapting our Programming to the COVID Reality

To understand the impacts of Covid-19 on our beneficiaries, women’s groups and programming and to develop a sustainable and contextually appropriate response, Grameen first consulted with our local partner RUFI, our agents working directly with groups in communities, local government officials, and elected refugee representatives.

RUFI emphasized that some members of the women’s groups we work with were still arriving one by one to make their regular savings, but they were definitely not meeting in groups. Despite the challenges, RUFI continued meeting with the group’s Management Committees to process bank account opening. We agreed it would be impossible to meet with the women’s groups during the lockdown, but it was vital to restart program activities and training with our community agents. After brainstorming several options, we chose to host Google Meet refresher trainings with the agents for the duration of the lockdown. Google Meet is reliable, free, offers video and presentation capabilities and has a user interface that less digitally literate individuals can easily adapt to. Our Uganda Technology Lead Joseph trained the first group of agents in August and is currently working with Grameen Tech Team members in the Philippines and Ghana to develop a simple digital literacy training that can be used in several countries to onboard the agents to Google Meet.

Responding to the Impacts of Covid-19 on Women's groups

Next, we talked with our women’s groups, local government officials and Refugee Welfare Officers (the elected representatives of refugee interests in the settlements) to understand how groups and individuals had been impacted by Covid-19. The groups we talked with told us that life during the lockdown was extremely difficult. While the groups understood that the lockdown was intended to curb the spread of Covid-19 and protect their health, social distancing combined with the significant drop in WFP food assistance had complicated their lives and the majority of families in the settlement could not make ends meet. Additionally, the Covid-19 outbreak--and especially the complete suspension of NGO operations during the lockdown-- left many people feeling hopeless and worried for their futures. Economically, refugees reported their businesses had contracted or temporarily collapsed because they could not travel to restock their businesses. Many families didn’t have enough income to meet their basic needs and were forced to reduce the number of daily meals they ate. Additionally, the groups had seen an increase in gender-based violence and child abuse, among other issues, since the lockdown began.

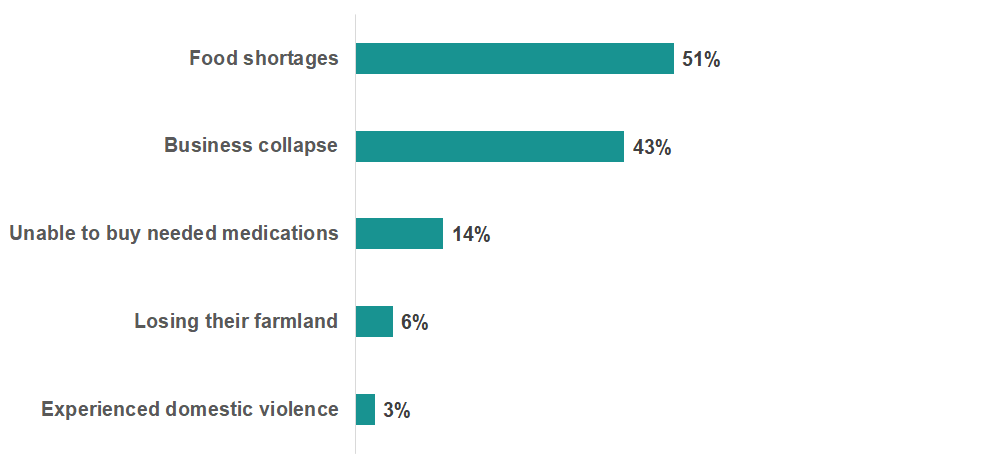

We interviewed 70 group members across two settlements, and they reported the following challenges:

Figure 1: How Covid-19 Impacted Our Group Members

To respond to these challenges, Grameen channeled private sector charitable giving into a rapid short-term emergency cash transfer initiative for 679 of the most vulnerable women in our groups, including the women with very large families, the elderly, chronically ill, and child-headed households. One big challenge we faced was limited ability to enter the refugee settlements due to the lockdown. To circumvent this, Grameen worked with local fintech partner, Beyonic, to deliver digital cash transfers directly to beneficiaries’ mobile money accounts. This enabled us to deliver emergency cash support quickly and safely to people we couldn’t reach physically. Our Program Manager received a notification once each cash transfer was completed on his phone and we utilized a two-layered feedback loop to ensure any irregularities in the transfers were reported and resolved immediately.

Conclusion

While the stringent Covid-19 lockdowns and social distancing restrictions put in place in Ugandan refugee settlements were enormously important in preventing the spread of the virus among vulnerable refugee populations, they also had a devastating short-term economic impact. The impact on refugee populations was compounded by the challenges organizations like Grameen Foundation and others faced in finding ways to continue to support the women we work with when in-person trainings and meetings are impossible.

What has become apparent over the past 6-plus months is that Grameen and other organizations’ focus on building digital and community agent networks over the past decade mitigated some challenges for vulnerable communities during Covid-19 lockdowns around the world. We were able to track activities that occurred through our community agents and savings groups, and to provide digital emergency cash transfers to help refugee women pay bills and buy food for their families. What’s more, we believe the technologies and frameworks we developed and tested to respond to Covid-19 will continue to help vulnerable populations facing profound threats to their lives and livelihoods though it will be important to continue to monitor and evaluate these interventions.

As we continue to innovate and try new things to best serve the worlds’ poor, we know the key is ensuring that digital innovations are relevant and appropriate to the women we are working with. With this in mind, we are committed to continuing to develop simple user-centered digital approaches that fit our women’s groups and agents’ abilities, and we look forward to onboarding more women into the digital world in the future.